What are you really paying?

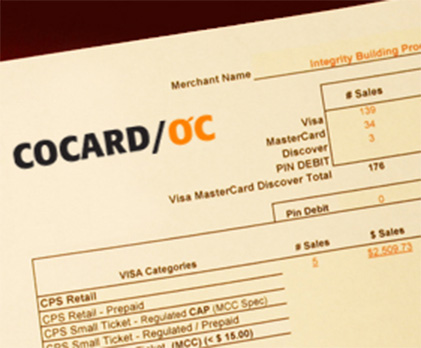

Fact: A low Base Discount Rate isn't everything. What is most important is your Effective Rate. Bottom Line, what does it cost you to process your credit cards, all fees included? For example, you may have a base discount rate of 1.59%, that may seem low, but with fees and surcharges added in, you may be paying well over 4.59%. (Total Monthly Fees divided by total sales monthly volume (hit % Key) equals your Effective Rate.)

How we lower your "Effective Rate"

We offer Interchange Plus, which is the True Bank Cost on all Card Types: B2B/Commercial Cards, Rewards Cards, Debit Cards, Keyed Transactions, (Mid-Qual, Non- Qual) etc. None of these transactions come in at the "up-front" base Discount Rate. Most merchants don't currently pay True Bank Cost on the card types. By applying Interchange (or True Bank Cost) to your Statement, we remove the Hidden Fees. This can mean $100's to $1000's of dollars per month in savings for Merchants doing $1OK and up in monthly Visa, Master Card, Discover, and Amex sales volume.

It's pretty simple. We offer full disclosure of all true costs direct from Visa/MC. We tell you what the banks and processors don't want you to know. And if you are paying more than you should, or if you don't know what your current provider is taking as a profit, then let us do a review for you. The Interchange is the True Bank Cost, and the 'plus' is our negotiated profit to earn your business.

Just fax over your current Visa/MC processing statement today and find out how many of your fees shouldn't be there. If you are getting overcharged, we will correct it. Then, we prove the savings every month for the first six, and quarterly thereafter. Our ongoing commitment to the merchant is our strength.